MSP INSURANCE

In the financial services sector, the Mobile Service Platform is already in use primarily in the field of insurance. MSP Insurance is an indispensable tool especially for the liquidation of damages and the conclusion of insurance policies (life insurance policy, property insurance and the list of maturity insurance premiums by type of insurance and policyholders on a given day).

MSP Insurance is an environment, installed on a modern platform, where the client prepares business rules for his own needs. MSP Insurance offers support to field workers in performing a variety of tasks.

- Electronic issuing of documents on the field.

- Electronic issuing of documents on the field.

- History of events related to the specific person.

- Internal, technical and marketing documentation.

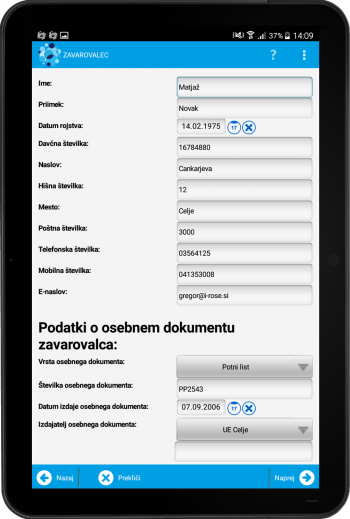

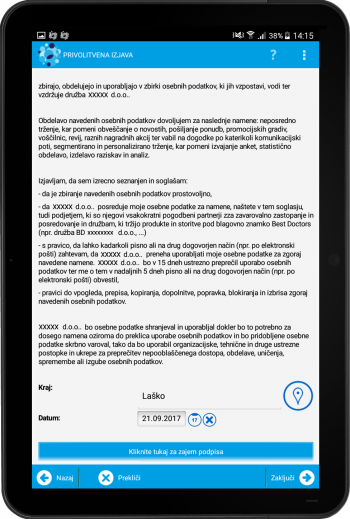

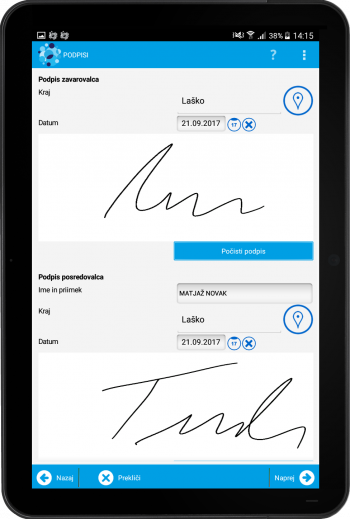

- The formalized conclusion of insurance policies.

- Organized sending of documents.

- Electronic repository of documents.

- Recording of the use of documents.

- Automatic calls.

- Visit notifications.

- Interventions.

- Travel orders.

Start using MSP Insurance now.

Advantages:

- Increase the efficiency of the field team.

- Fast data flow between the back-end system and the field team.

- Automatic referral of the field team to the destination addresses.

- Planning of visits and detour routes.

- An overview of field work.

- Logging of geo-coordinates and time of events.

- The possibility of integration of external services.

- KPI reports according to company requirements.

Are processes in your company completely different?

Check out different ways how Mobile Service Platform can be used.

Solutions and functionalities:

- Rute planning.

- Integration with the back-end system.

- The geographic location of visits (GPS coordinates).

- Measuring the time of client’s visit.

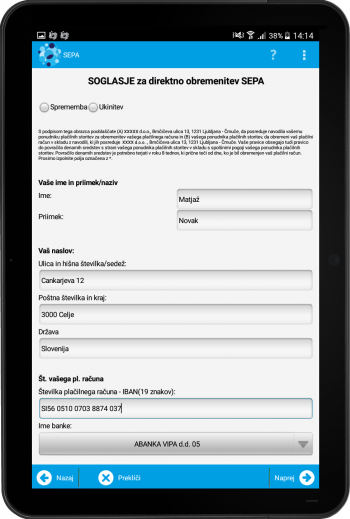

- Verification of the entered data (tax numbers, TRR, address).

- The solution is based on i.e. “Web service” call.

- Electronic SEPA form.

- Protecting client data.

- Telephone services via MSP.

- Integration with telephone central office.

- Automatic synchronization.

- Protection against abuse.

- Disabled data manipulation, alerts in case of data fabrication.